Debunking Offshore Business Formations: How They Run and What to Anticipate

Offshore firm formations can appear complex and enigmatic. Offshore Company Formations. These entities, usually developed for tax advantages and personal privacy, operate under unique lawful frameworks. Entrepreneurs may find themselves navigating through a labyrinth of laws and conformity requirements. Comprehending the intricacies is important for success. What are the real advantages? What are the possible risks? A closer exam reveals the nuances that might influence decision-making significantly

Understanding Offshore Companies: Meanings and Kinds

Offshore business are entities developed in a jurisdiction beyond a person's or company's key nation of house, often for functions related to tax obligation optimization, property protection, or governing advantages. These firms can take different kinds, consisting of minimal obligation firms (LLCs), international service companies (IBCs), and offshore counts on. Each type serves details functions and interest various needs.

Minimal liability companies provide owners with security from individual obligation, while global service firms are prominent for their flexibility and very little reporting demands. Offshore trusts, on the various other hand, are used mainly for estate preparation and asset security.

The selection of territory greatly affects the company's procedures, as some places use more beneficial legal frameworks and privacy securities. Offshore Company Formations. Comprehending the differences in between these types is essential for people and businesses considering overseas frameworks, as each alternative carries various effects for administration and conformity

The Advantages of Developing an Offshore Firm

Developing an overseas company can provide numerous benefits, particularly for those seeking to boost their economic techniques and shield their assets. One considerable benefit is tax optimization; numerous jurisdictions provide desirable tax rates or exemptions, allowing companies to retain more revenues. Furthermore, offshore firms can give a layer of privacy, securing the identities of owners and shareholders from public analysis.

An additional benefit is asset defense. By putting possessions in an overseas entity, people can safeguard their riches from prospective lawful insurance claims or political instability in their home nations. This structure also facilitates global company procedures, making it possible for less complicated access to global markets and varied customers.

Additionally, the establishment of an overseas firm can improve trustworthiness and prestige, interesting customers who value global organization practices. Overall, these benefits make offshore firm formations an eye-catching choice for individuals and companies going for monetary growth and safety.

Secret Considerations Prior To Creating an Offshore Entity

Before developing an overseas entity, a number of vital aspects should be assessed. Legal compliance demands, tax effects and benefits, in addition to jurisdiction selection, play a substantial function in the decision-making process. Understanding these factors to consider can aid companies and people navigate the complexities of offshore firm formations successfully.

Lawful Compliance Requirements

When considering the formation of an offshore entity, understanding lawful compliance needs is necessary to ensure adherence to both worldwide and neighborhood legislations. Prospective organization proprietors should acquaint themselves with policies controling company registration, reporting commitments, and operational criteria in the selected territory. This includes confirming the lawful requirements for directors and investors, as well as making sure conformity with anti-money laundering (AML) and know-your-customer (KYC) policies. Additionally, services should continue to be familiar with any kind of licensing demands specific to their market. Involving local legal and economists can supply important insights, making sure that all essential documentation is prepared and submitted appropriately. Eventually, complete understanding of legal conformity helps reduce risks and promotes a sustainable offshore operation.

Tax Obligation Implications and Benefits

Various local business owner consider the tax effects and advantages of developing an offshore entity as an important element in their decision-making procedure. Offshore companies can supply considerable tax benefits, such as minimized corporate tax obligation rates, exemption from specific regional taxes, and the capability to delay taxes on foreign income. These benefits can lead to boosted profitability and cash flow, making overseas frameworks appealing for global service procedures. Additionally, the potential for tax treaties might better lessen tax obligations. It is important for organization owners to recognize the complexities involved, consisting of compliance with both regional and worldwide tax obligation regulations. Involving with tax obligation professionals is advisable to browse these complexities effectively and assure suitable tax obligation planning methods.

Territory Selection Aspects

What aspects should one think about when selecting a jurisdiction for overseas firm development? Key factors to consider include tax obligation efficiency, governing atmosphere, and political stability. Territories with positive tax obligation regimens can significantly affect earnings. The governing landscape should offer flexibility and ease of compliance, allowing for efficient company operations. Political stability is important, as it guarantees the safety of assets and continuity of operations. Additionally, the track record of the territory can impact client count on and service partnerships. Availability to financial services and the accessibility of expert assistance solutions are additionally important. Recognizing neighborhood regulations regarding coverage, personal privacy, and possession needs is important to ascertain that the offshore entity lines up with the business owner's goals and legal responsibilities.

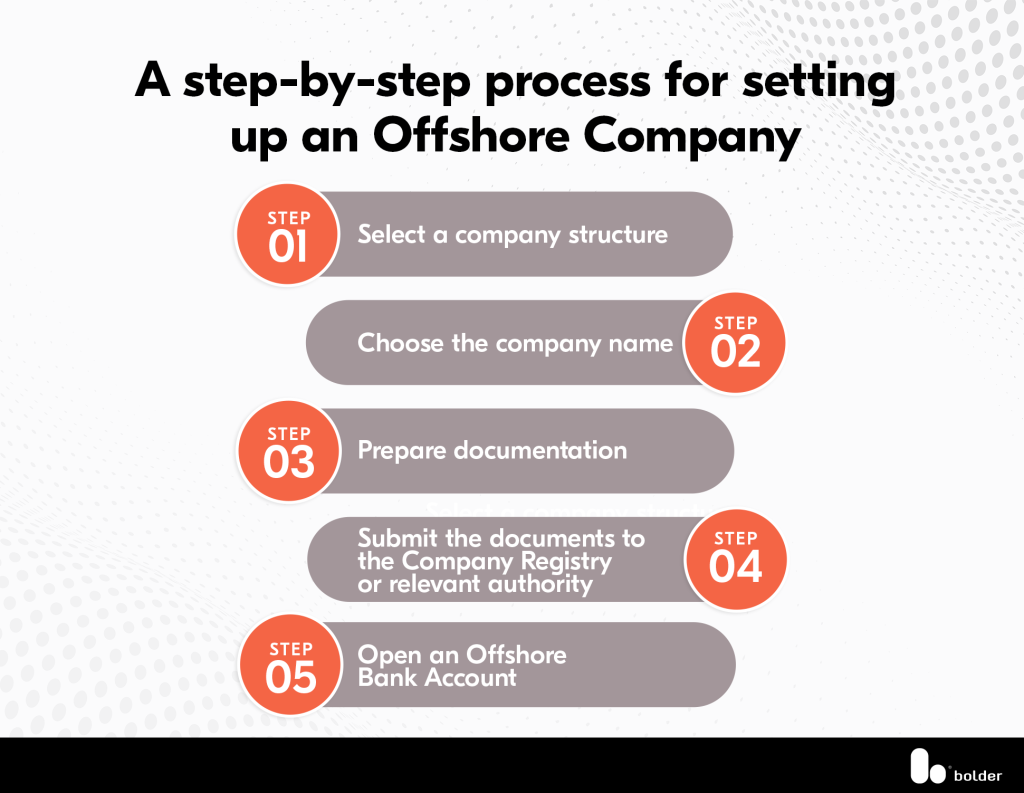

The Process of Establishing an Offshore Business

Establishing an offshore firm includes a collection of tactical steps that need careful preparation and conformity with global guidelines. A private must pick an appropriate jurisdiction that lines up with their business purposes and uses beneficial tax benefits. Adhering to jurisdiction selection, the next action is to choose a distinct business name and prepare the essential paperwork, including articles of unification and shareholder arrangements.

Once the documentation prepares, it must be sent to the pertinent authorities together with the called for fees. After approval, the business will obtain a certification of consolidation, formally developing its legal presence. The individual have to after that open up a corporate savings account to assist in economic deals.

Ultimately, keeping an offshore firm includes adhering to recurring compliance requirements, such as yearly reporting and tax obligations, which vary by territory. Understanding each action is crucial for an effective offshore company development.

Lawful and Governing Structure for Offshore Firms

While developing an offshore business can offer considerable advantages, it is necessary to steer through the complex legal and governing structure that regulates such entities. Each jurisdiction has its own set of laws that determine every little thing from business development to taxes and compliance requirements. These policies are designed to stop illegal tasks, such as cash laundering and tax evasion, and often require comprehensive documents and transparency.

Key elements of this framework include the requirement of selecting regional directors, keeping an authorized workplace, and sticking to annual reporting obligations. Furthermore, many territories enforce certain licensing needs for sure organization tasks. Recognizing these lawful terms is vital for making sure compliance and mitigating risks connected with penalties or lawful disagreements. As a result, engaging with lawful specialists who focus on overseas business can aid in navigating via this intricate landscape, inevitably facilitating a compliant and effective offshore service procedure.

Common Misunderstandings About Offshore Firms

Many individuals hold mistaken beliefs regarding offshore companies, typically corresponding them with tax evasion and illegal activities. Nevertheless, it is necessary to identify that these entities can run legally within a structure created for reputable service techniques. Making clear the legal status of overseas companies can aid dispel these myths and advertise a much more precise understanding of their objective.

Tax Evasion Misconceptions

In spite of the growing appeal of offshore business, mistaken beliefs about their usage for tax evasion continue. Lots of individuals erroneously believe that developing an offshore entity is only a means to stay clear of taxes. Overseas companies are frequently utilized for reputable functions, such as asset protection, global service expansion, and investment diversification. The perception that all offshore activities correspond to illicit tax evasion neglects the complexities of global tax regulations and compliance requirements. Furthermore, the vast majority of overseas territories have executed actions to combat tax obligation evasion, promoting transparency and details exchange. This mischaracterization can hinder legitimate services and capitalists from discovering the prospective advantages of overseas company formations while bolstering a negative stigma bordering these entities.

Lawful Condition Clarified

The legal standing of offshore companies is often misinterpreted, resulting in a variety of misconceptions. Numerous think these you can check here entities run in a lawful click to investigate gray location, presuming they are dishonest or inherently unlawful. Actually, overseas firms are genuine companies created under the regulations of specific jurisdictions, made for various reasons, including asset defense and market growth. Another typical misconception is that overseas firms avert taxes entirely; nonetheless, they undergo the policies and tax responsibilities of their home nations. Furthermore, some people believe that offshore companies can be quickly exploited for money laundering or illegal tasks. While abuse can happen, a lot of territories apply strict compliance and transparency regulations to reduce such risks, making certain that overseas companies run within legal frameworks.

Taking care of and Running Your Offshore Company Efficiently

Successfully taking care of and running an overseas firm requires a strategic method that stabilizes conformity with neighborhood laws and the search of business objectives. Effective overseas management involves comprehending the territory's tax laws, reporting demands, and operational laws. Using neighborhood specialists, such as accountants and legal consultants, can supply indispensable understandings into traversing these complexities.

Additionally, establishing clear communication channels and operational protocols is important for preserving efficiency. Making use of technology for project management and partnership can improve productivity, while normal performance assesses warranty positioning with critical purposes.

Additionally, preserving robust financial records is vital, as transparency cultivates depend on with stakeholders and abide by international criteria. Lastly, being adaptable to adjustments in regulations or market conditions enables offshore business to pivot efficiently, assuring long-lasting sustainability and growth. By adhering to these concepts, entrepreneur can make the most of the advantages of their overseas endeavors while mitigating threats.

Frequently Asked Concerns

Exactly how Much Does It Expense to Preserve an Offshore Firm Each Year?

The expense to keep an offshore business yearly varies substantially, normally varying from $1,000 to $5,000, depending on territory, solutions needed, and conformity commitments. It is important to think about added charges for details needs.

Can I Open a Financial Institution Account for My Offshore Firm Remotely?

Opening a financial institution account for an overseas company from another location is normally possible. However, demands may differ by territory, frequently requiring documents and verification processes, which can complicate the remote application experience for people.

Are There Details Countries Understood for Easier Offshore Firm Formations?

Certain countries, such as Belize, Seychelles, and the British Virgin Islands, are renowned for their structured procedures and favorable policies relating to offshore company developments, drawing in business owners seeking performance and discretion in service operations.

What Kinds of Businesses Are Ideal Fit for Offshore Companies?

Certain services, such as consultancy, financial investment, and shopping firms, frequently gain from overseas firms because of tax obligation advantages, personal privacy, and regulatory adaptability - Offshore Company Formations. These entities usually thrive in territories that advertise desirable company settings

How Can I Make Sure Conformity With Regional Regulations When Operating Offshore?

To assure compliance with neighborhood legislations when running offshore, it is important to involve lawful experts, carry Check Out Your URL out thorough research study on jurisdiction regulations, and maintain clear economic documents, thus decreasing risks connected with non-compliance.